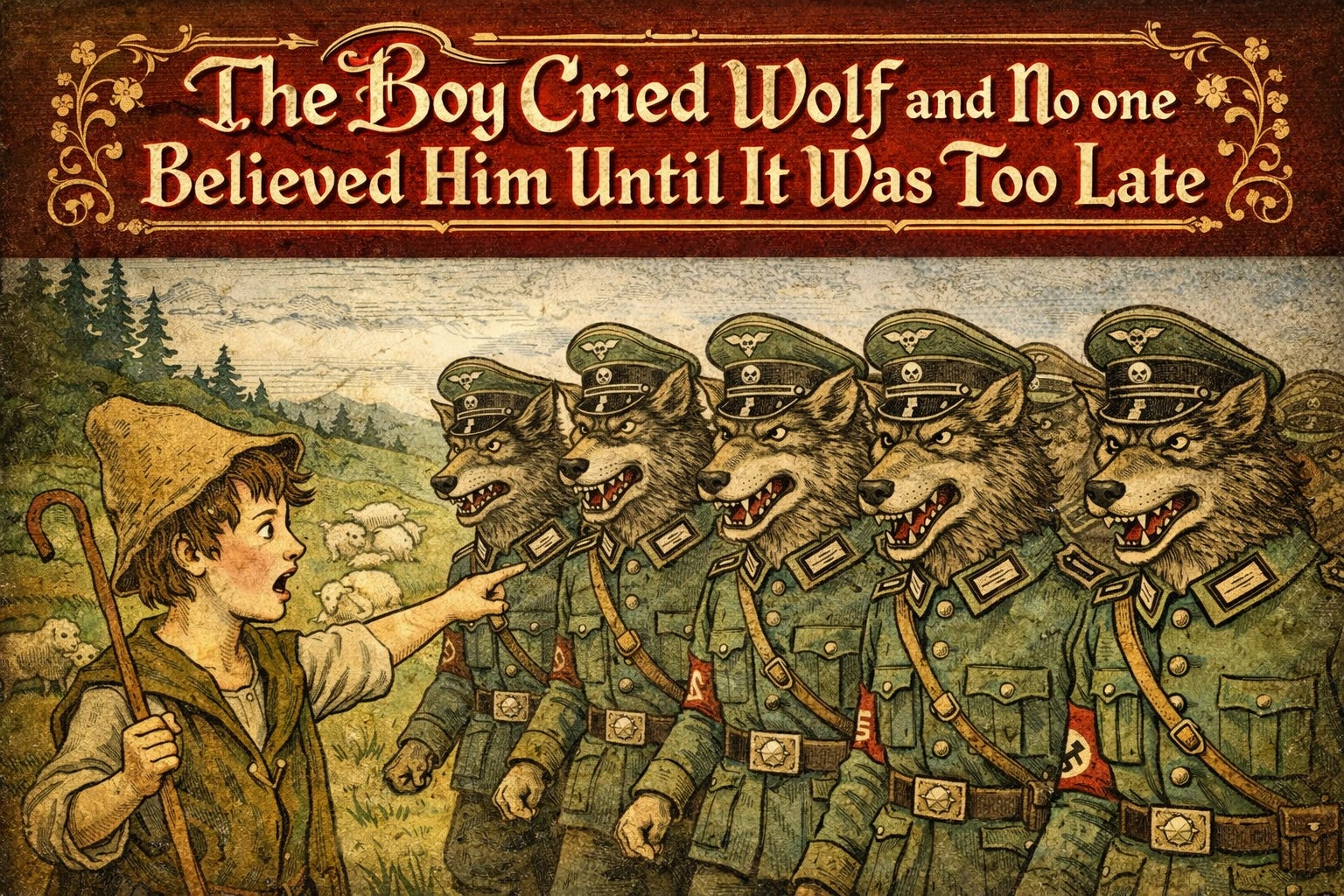

The parable of the boy who cried wolf has long been a cautionary tale about the consequences of dishonesty and the importance of maintaining credibility. However, in today's volatile economic landscape, this classic story can offer profound insights into navigating the complexities of financial crises and the critical need to heed early warning signs.

Heed the Early Warnings Just as the villagers in the story initially dismissed the boy's cries, many individuals and institutions often fail to take seriously the early warning signs of impending economic turmoil. Whether it's the rumblings of a housing bubble, the unsustainable growth of a particular industry, or the accumulation of unsecured debt, we have a tendency to ignore the warning signs, lulled into a false sense of security by the temporary stability of the status quo.

The lesson from the boy who cried wolf is clear: when genuine threats emerge, our ability to respond effectively is compromised if we have repeatedly dismissed or disregarded the preceding warnings. In the financial realm, this can translate into devastating consequences, from the collapse of major corporations to the erosion of individual wealth and retirement savings.

The Importance of Credibility The boy's eventual lack of credibility when the wolf finally arrived was his undoing. Similarly, in the world of finance and economics, maintaining a reputation for truthfulness and transparency is crucial. Governments, regulatory bodies, and industry leaders must be vigilant in providing accurate, timely, and actionable information to the public, even if it means acknowledging potential risks or vulnerabilities.

When these institutions and individuals lose the trust of the people, their ability to effectively manage crises and guide the public through turbulent times is severely hindered. Just as the villagers in the story were unwilling to believe the boy's final cry, the public may become increasingly skeptical of official narratives and warnings, leading to a breakdown in communication and a fragmented response to economic challenges.

The Consequences of Inaction In the original tale, the boy's careless actions ultimately led to the destruction of his flock and potentially his own demise. Similarly, in the realm of finance and economics, the consequences of ignoring or downplaying early warning signs can be catastrophic.

The 2008 financial crisis, for example, was a stark reminder of the devastation that can occur when systemic risks are allowed to accumulate unchecked. Millions of people lost their homes, savings, and livelihoods as a result of the collapse of the housing market and the subsequent recession. This crisis underscored the need for vigilance, transparency, and proactive measures to mitigate the impact of economic downturns.

Embracing Responsible Stewardship Just as the boy in the story should have taken his duties as a shepherd more seriously, those entrusted with the stewardship of the economy must embrace a sense of responsibility and accountability. This means not only heeding the early warning signs but also taking decisive and transparent actions to address emerging threats before they spiral out of control.

By fostering a culture of openness, honesty, and a willingness to confront challenges head-on, we can build a more resilient and responsive financial system that is better equipped to weather the storms of economic volatility. Only then can we avoid the tragic consequences that befell the boy and his flock, and ensure that the cries for help are heard and heeded when they matter most.

"The truth doesn't hide. It waits for those brave enough to look."

The Wise Wolf