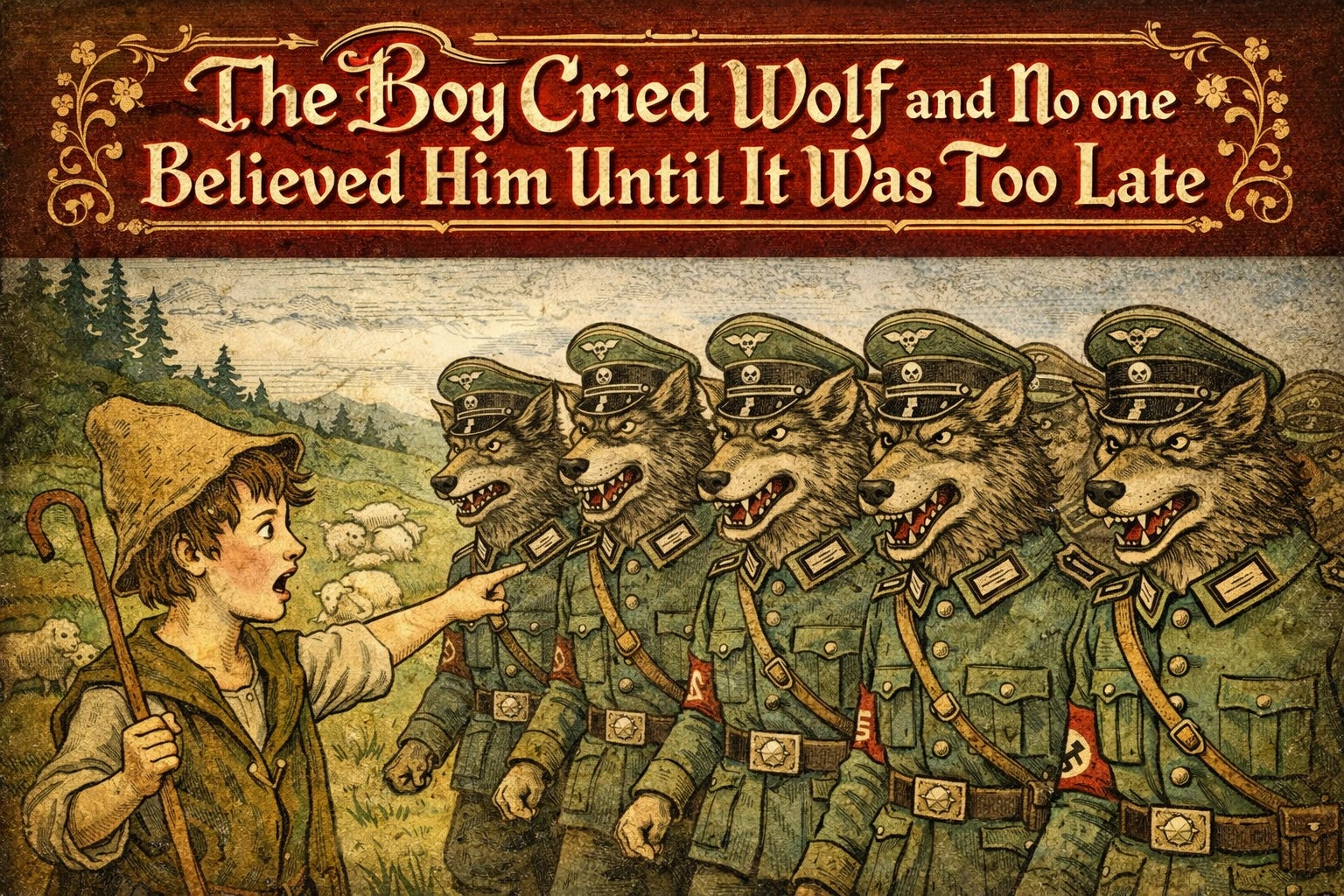

The classic fable of the boy who cried wolf has long been a cautionary tale about the consequences of deception and the importance of trust. In today's rapidly changing economic landscape, this timeless story holds profound lessons for individuals and policymakers alike. As we navigate the complexities of financial markets, geopolitical tensions, and the ever-present specter of economic collapse, it's crucial that we heed the warnings and avoid the pitfalls that befell the hapless shepherd boy.

Crying Wolf in a World of Volatility

The boy's initial mischief, fueled by boredom and a desire for attention, set in motion a series of events that would ultimately lead to disaster. In much the same way, economic and political actors can sometimes be tempted to cry wolf, exaggerating or distorting the true nature of the challenges facing their communities or nations. Whether it's policymakers downplaying the severity of an impending recession, or financial pundits hyping the next big market trend, the urge to grab headlines and sway public opinion can be strong.

However, as the fable so vividly illustrates, this strategy is a dangerous one. When the villagers eventually refused to believe the boy's cries, they were left defenseless against the very real threat they had dismissed. In the economic realm, a similar dynamic can play out, with the public becoming increasingly skeptical of warning signs and experts being ignored when their predictions finally come to pass.

The Perils of Complacency

The underlying lesson of the boy who cried wolf is not just about the dangers of deception, but also about the perils of complacency. The villagers, having been fooled repeatedly, became complacent in their response to the boy's warnings. They assumed that, as before, there was no real threat and that they could safely return to their daily lives.

In the realm of economics and finance, this kind of complacency can be equally perilous. When warning signs of an impending crisis are dismissed or downplayed, it can lull individuals, businesses, and policymakers into a false sense of security. They may fail to take the necessary precautions or make the difficult decisions required to weather the storm, only to be caught off guard when the proverbial wolf finally arrives.

Rebuilding Trust in a Skeptical World

Navigating the complexities of the modern economy requires a delicate balance between vigilance and nuance. While it's important to heed the warnings of those who have proven their credibility, it's equally critical to approach economic forecasts and policy proposals with a critical eye. Just as the villagers in the fable were right to be skeptical of the boy's cries, so too must we be discerning in the information we choose to trust.

Rebuilding this trust is no easy task, but it begins with a commitment to transparency, accountability, and a willingness to engage in honest, evidence-based dialogue. Policymakers must be willing to acknowledge their mistakes and adjust their approaches accordingly, while the public must be open to reconsidering their biases and preconceptions. Only by fostering a culture of mutual understanding and respect can we hope to navigate the economic challenges that lie ahead.

Conclusion: Heeding the Lessons of the Past

The story of the boy who cried wolf serves as a powerful metaphor for the complexities of the modern world. As we grapple with the specter of economic collapse, it's crucial that we learn from the mistakes of the past and heed the warnings of those who have proven their credibility. By staying vigilant, maintaining a critical eye, and rebuilding trust in our institutions and experts, we can better prepare ourselves for the challenges that lie ahead and avoid the tragic fate that befell the hapless shepherd boy.

"The truth doesn't hide. It waits for those brave enough to look."

The Wise Wolf