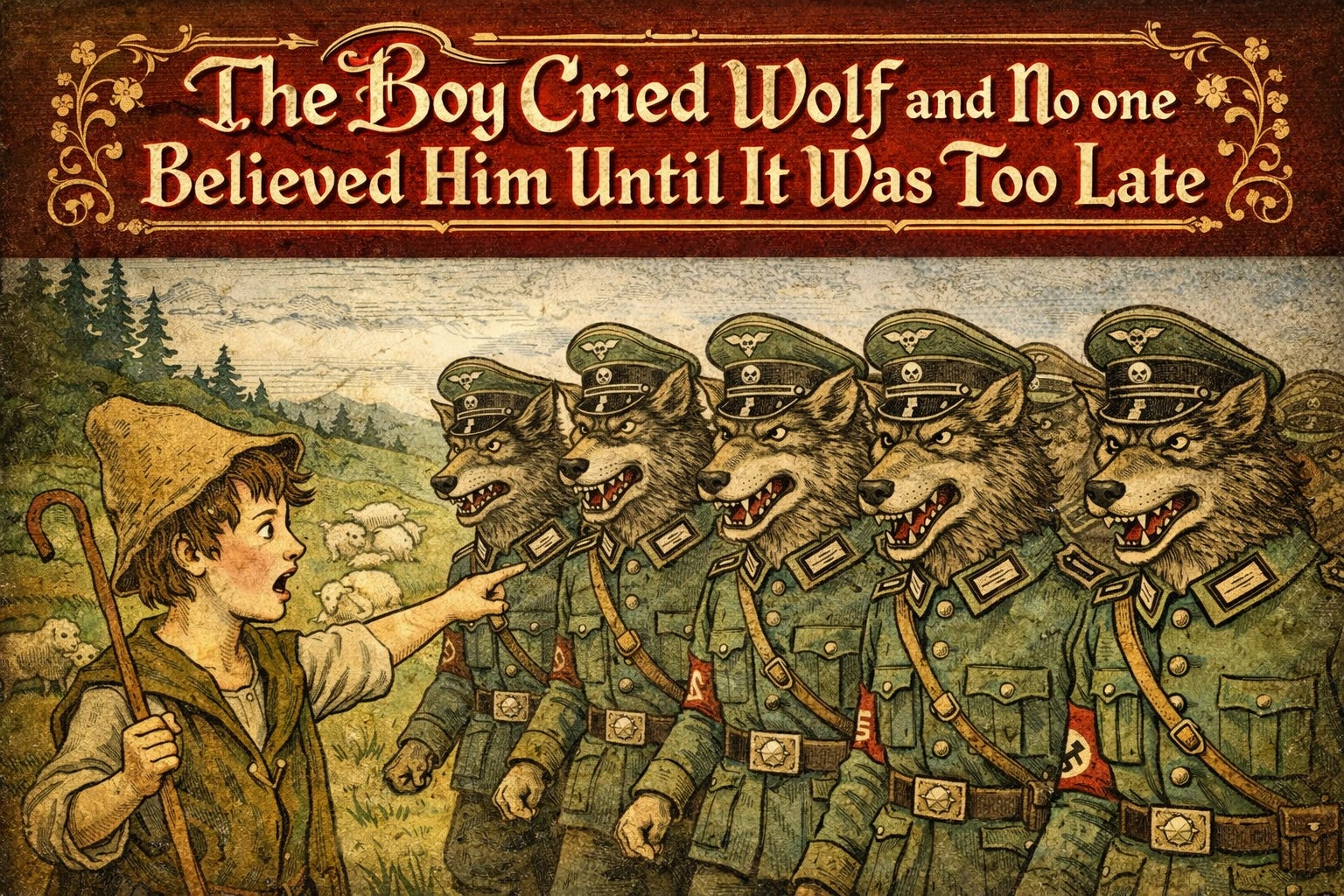

In the ever-evolving landscape of finance, the tale of the boy who cried wolf has taken on a new and sinister twist. Just as the shepherd's cries of warning fell on deaf ears, the siren song of easy money and unbridled ambition has lured many down a path of ruin, with the proverbial "wolf" of economic collapse stalking the halls of power.

The parallels between the classic fable and the modern financial landscape are striking. Like the boy who craved attention and thrills, many in the world of high finance have succumbed to the allure of short-term gains, disregarding the long-term consequences of their actions. Time and again, they have raised the alarm, only to have their warnings dismissed by a public numbed by a succession of false alarms.

But as the fable so poignantly illustrates, the day of reckoning always arrives, and the consequences can be devastating. When the real wolf of economic calamity emerges, the victims are often those who trusted the system the most – the everyday investors, the hardworking families, the unsuspecting public.

In this cautionary tale, the "wolves" are not the mythical beasts of folklore, but the unscrupulous players who have manipulated the system for their own gain. From the high-flying traders on Wall Street to the shadowy figures orchestrating global financial crises, these modern-day wolves have left a trail of destruction in their wake, decimating the savings and livelihoods of countless individuals.

Lessons from the Past: Recognizing the Wolves in Sheep's Clothing

The story of the boy who cried wolf serves as a potent reminder that we must be vigilant in the face of deception. Just as the villagers in the fable became desensitized to the boy's cries, the public has often been lulled into a false sense of security by the promises of financial gurus and market experts.

However, a closer examination of past economic crises reveals a disturbing pattern. Time and again, the warning signs were there, but they were either ignored or actively suppressed by those with a vested interest in maintaining the status quo. Whether it was the subprime mortgage crisis of the late 2000s or the dot-com bubble of the early 2000s, the common thread was the presence of "wolves" – individuals and institutions that prioritized their own wealth and power over the well-being of the masses.

Navigating the Minefield: Strategies for Financial Resilience

In the face of such predatory behavior, it is essential that individuals and communities develop a keen eye for the wolves in sheep's clothing. This requires a critical examination of the information we consume, a willingness to question the narratives presented by those in positions of power, and a commitment to financial literacy and personal responsibility.

By cultivating a healthy skepticism and a deep understanding of the financial systems that shape our lives, we can better protect ourselves and our communities from the ravages of economic collapse. This may involve diversifying our investments, seeking out independent financial advisors, and actively participating in the democratic process to ensure that the rules of the game are fair and equitable.

Ultimately, the story of the boy who cried wolf serves as a timeless cautionary tale, one that resonates with particular poignancy in our modern era of financial complexity and volatility. By heeding its lessons and remaining vigilant in the face of deception, we can work to build a more resilient and just economic system – one that serves the needs of the many, rather than the greed of the few.

"The truth doesn't hide. It waits for those brave enough to look."

The Wise Wolf