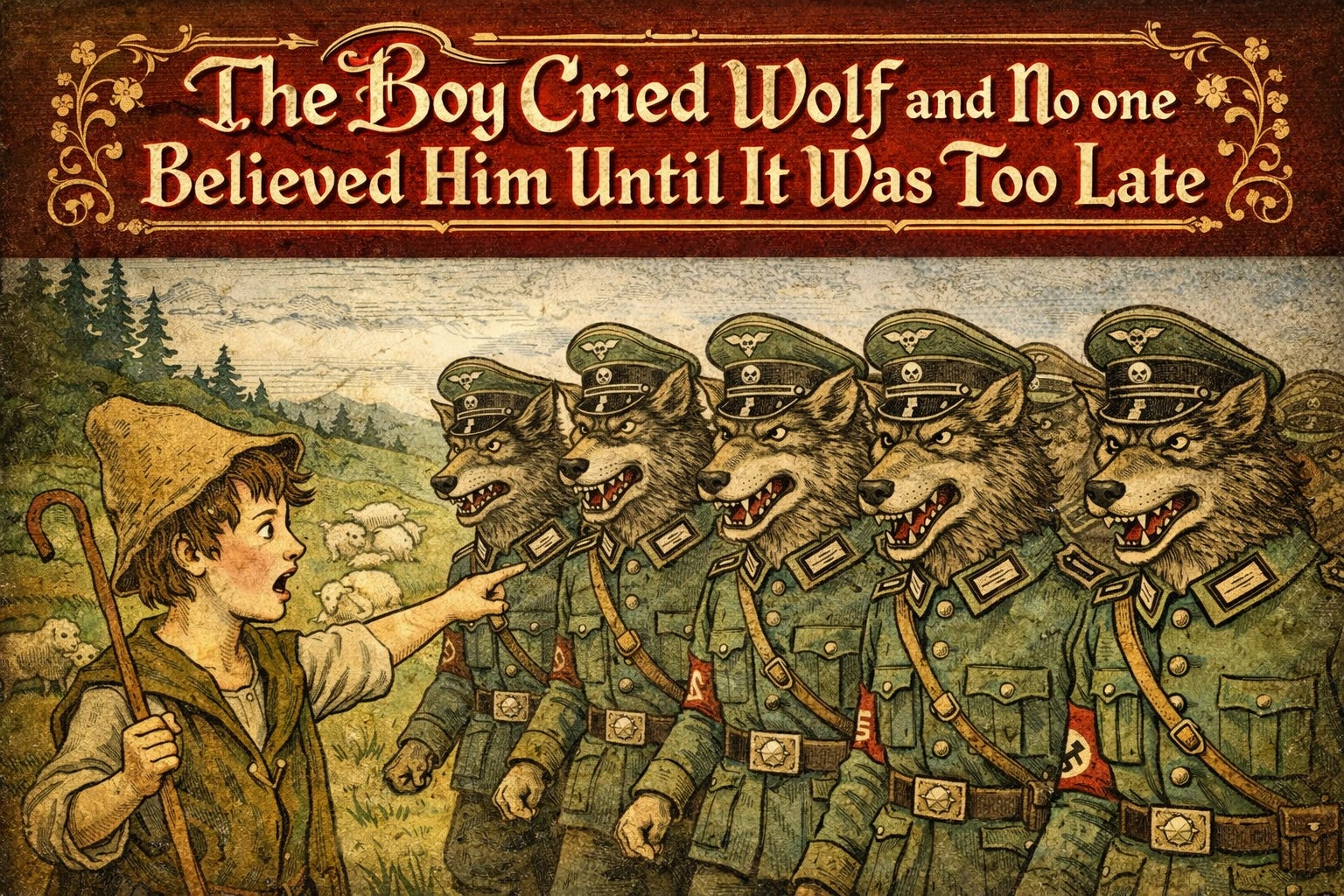

In the ever-evolving landscape of our society, we are often confronted with cautionary tales that serve as a stark reminder of the consequences of our actions. One such tale, the classic fable of the boy who cried wolf, has become a timeless metaphor for the dangers of deception and the erosion of trust. Yet, as we delve deeper into the complexities of the modern world, we find that this age-old story has taken on a new and unsettling relevance, particularly in the realm of finance and economic collapse.

Cry Wolf: The Rise of Corporate Deception The boy's initial cries of "Wolf! Wolf!" may have been born out of boredom or a desire for attention, but the underlying message remains poignant: the more we disregard the warnings of those around us, the more vulnerable we become to real and imminent threats. In the high-stakes world of finance, we have witnessed a similar pattern of behavior, where corporate leaders and financial institutions have engaged in a relentless pursuit of profit, often at the expense of transparency and ethical conduct.

The Wolves of Wall Street Just as the villagers in the fable dismissed the boy's cries, many investors and regulators have become desensitized to the warnings of impending financial crises. The rise of the "Wolf of Wall Street" mentality, where greed and self-interest trump the well-being of the masses, has led to a breakdown in trust and a growing sense of uncertainty. These corporate wolves, driven by a thirst for power and wealth, have repeatedly cried "Wolf!" in the form of misleading financial reports, predatory lending practices, and reckless investment strategies, only to retreat unscathed as the consequences of their actions ripple through the economy.

The Price of Disbelief The tragic irony of the boy's story is that when the real wolf finally arrived, no one believed him, and the consequences were devastating. In the realm of finance, we have witnessed a similar pattern, where the cries of economic collapse have been dismissed or ignored, only to be followed by the harsh realities of recession, job losses, and widespread financial hardship.

Lessons from the Past, Hope for the Future As we grapple with the aftermath of these crises, it is essential that we heed the lessons of the past and strive for a more transparent, accountable, and ethical financial system. By fostering a culture of trust, embracing transparency, and holding corporate leaders and financial institutions accountable for their actions, we can prevent the "wolves" from wreaking havoc on our economic well-being.

The fable of the boy who cried wolf may have started as a simple cautionary tale, but in the modern era, it has taken on a new and urgent relevance. As we navigate the complex and interconnected world of finance, let us remember the importance of heeding the warnings of those who seek to protect the common good, lest we find ourselves at the mercy of the real "wolves" that lurk in the shadows of our economic landscape.

"The truth doesn't hide. It waits for those brave enough to look."

The Wise Wolf